COVID Losses Cash Back Bonus – up to triple the benefits!

Due to the impact of COVID-19, the government want to give businesses who have suddenly suffered significant losses, an opportunity to get some additional cash back into their struggling business.

In the 2021 Budget changes were announced to enhance the current Loss Relief Rules. The enhanced relief is mainly targeted at the more stable businesses who were previously successful and have suffered unforeseen losses as result of the global pandemic. Ultimately, it’s for those businesses that stand the greatest long-term chance of employing people again and paying tax in the future.

For those businesses that have been hit hard by COVID, you can receive a cash boost of up to two years extra tax back, for years previously paid to help get through these challenging times.

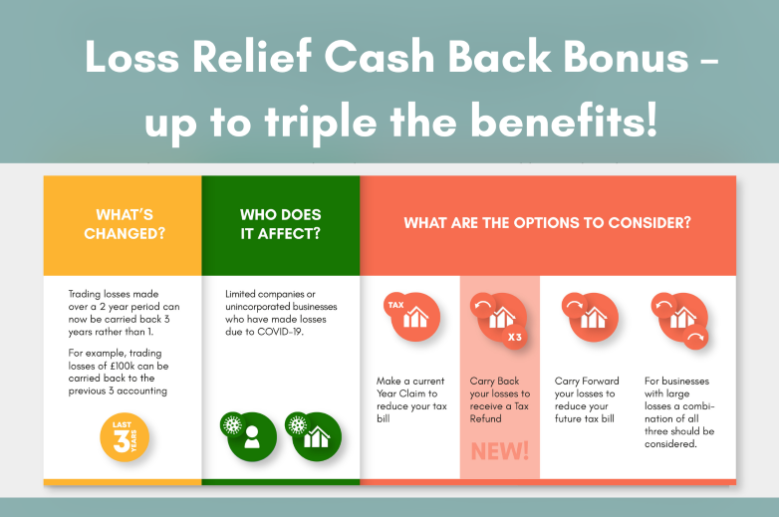

What’s new?

For business that have made a trading loss since April 2020 and/or forecast to make a loss up until 31st March 2022, those losses can now be carried back over the last three previous accounting periods/tax years, not just the last one.

The relief is capped at £2m of losses for each year that the relief is in place (£4m in total), and will only benefit limited companies, sole traders and partnerships that have made a profit in one or more of the last three years.

What are my options?

Your immediate thoughts are probably ‘great, sign me up!’. However, depending on your business circumstances you need to consider the different options to ensure you maximise this opportunity for your business.

There are three main options:

- Make a current Year Claim to reduce your tax bill

- Carry Back your losses to receive a Tax Refund

- Carry Forward your losses to reduce your future tax bill

For businesses with large losses a combination of all three should be considered.

There are other ways to use your losses…..

If your business has made a loss and is eligible to claim R&D Tax Relief, or even Creative Tax Relief, it’s important we consider this alongside the above options. You need to explore the best way to utilise these trading losses – we can help make sure you do this in the most favourable way.

If your business has made a trading loss since April 2020, book a call 01544 350214 and let’s discuss the best route to get a tax relief cash bonus back into your business.